Business Insurance in and around Chesapeake

One of Chesapeake’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Help Protect Your Business With State Farm.

Whether you own a a toy store, an antique store, or a bakery, State Farm has small business insurance that can help. That way, amid all the various moving pieces and options, you can focus on what matters most.

One of Chesapeake’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Get Down To Business With State Farm

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Mike Lindsey. With an agent like Mike Lindsey, your coverage can include great options, such as business owners policies, commercial liability umbrella policies and commercial auto.

Since 1935, State Farm has helped small businesses manage risk. Reach out to agent Mike Lindsey's team to identify the options specifically available to you!

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

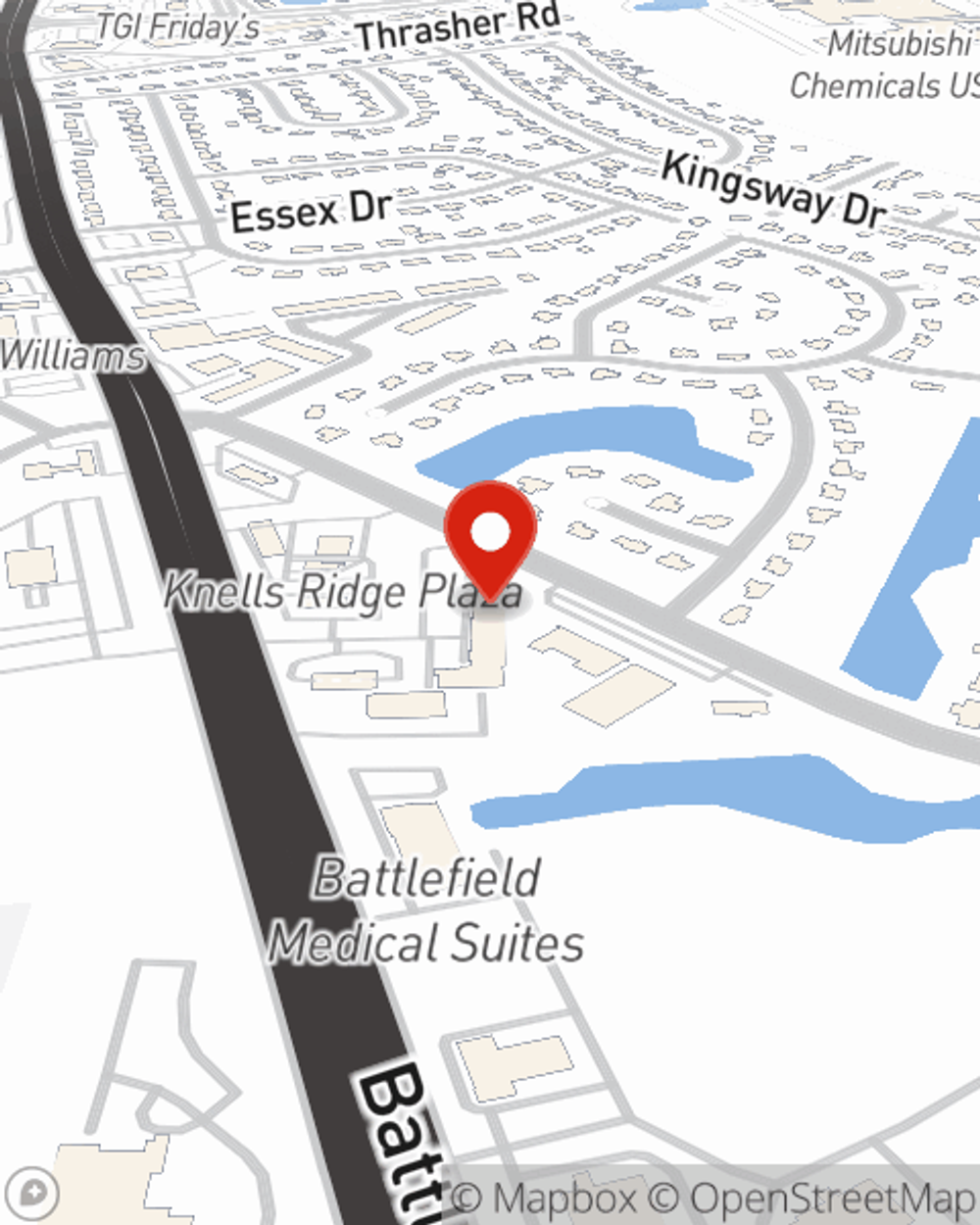

Mike Lindsey

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.